Waverton CIO Bill Dinning reviews the global outlook in April 2023 and explains why the firm remains cautious in its views.

The failure of Silicon Valley Bank on March 10 has had a significant impact on expectations for monetary policy. Three days before the bank collapse the market was expecting two more rate hikes from the Fed and possibly a single cut by January 2024. Now the market gives only a 70% probability of a single further hike and a 100% probability of three cuts by January 2024.

The only way that happens is if we get a recession. The “good news” is that another indicator has joined the list of cyclical indicators suggesting that a recession will indeed happen. A measure of small business confidence is at its lowest level since the 1980 recession. The equity market may not like the above narrative but for now it’s focusing on the coming rate cuts and not on the reason for them. We remain cautious.

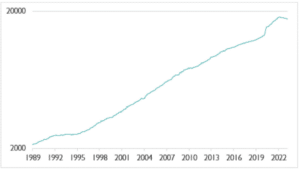

Deposits in US Commercial Banks $ billion (log scale)

One of the notable things about the banking problems in March was that customers withdrew deposits from the troubled banks at a rapid rate in the days leading up to collapse. Silicon Valley Bank lost $42 billion of deposits on 9 March, 24% of its total deposits. The bank was shut by regulators the next day when it is reported it would have seen another $100bn of outflow.

Traditionally regulators close troubled banks over a weekend to give them time to contain any fallout while the global banking system is closed. Silicon Valley couldn’t get to the weekend and was shut on Thursday 10 March. The problem is that with mobile banking apps, removing money from your account is much easier than it used to be. As recently as 2007, Northern Rock collapsed with queues of people outside branches which was the only way to get money out.

This has created concern that other banks could very quickly get into trouble. The chart above shows the level of deposits in US commercial banks. They are lower than a year ago for the first time since 1994.

A big driver of this is not panic about bank health but a result of rising interest rates. Money market funds, which generally offer interest rates that are similar to those available in the Treasury Bill market, have attracted more assets as they offer much higher savings rates than banks do. The bottom chart shows growth in those funds. Assets are 13% higher than a year ago.

When bank deposits were last declining in 1994 the Fed was in the midst of a tightening cycle too. We suspect that part of the solution for US banks looking to replenish deposits will be to raise savings rates. We do not see an existential banking crisis at present. Banks are just not being competitive in a world of higher interest rates.

Implied US Fed Funds rate %

The woes of Silicon Valley Bank and the government response to it had a dramatic impact on rate expectations across the globe but particularly in the US.

The chart above shows current expectations for Federal Reserve policy and those expectations on 7 March, three days before the bank crises erupted. Then the peak Fed Funds rate was expected to be at least 5.5% and the rate in January 2024 was expected to still be over 5.25%.

Now the peak is expected to be either at the current level or perhaps after one more hike in May. There is a 69% probability of a hike in May currently priced. The rate in January 2024 is expected to be 4.08%, a full 1% lower than it was on 7 March.

So although the majority of Fed officials have said in the minutes of their policy making meetings, and in other forums, that rates will need to stay high through this year, the market is pricing for rate cuts starting in September.

We suspect the only way that happens is if we see material improvements in the inflation picture and clear signs of much weaker domestic demand.

NFIB Small Business Good Time to Expand Index and Recessions 1974 – current

The National Federation of Independent Business (NFIB) was founded in 1943 and is an association of small businesses. It has conducted a survey of its members since December 1973 which is a closely watched indicator of sentiment in an extremely important part of the US economy.

The survey asks ten questions around how optimistic the members are. One of the questions, “is now a good time to expand” your business, is graphed above.

The reading in March was at its lowest level since the 1980 recession.

Our conclusion from this chart is that the risk of a US recession at this point is material.

Approximately 47% of US workers are employed by small businesses (defined as employing 500 or fewer workers). Very few of these businesses are publicly traded so this survey offers an insight into the health of an important indicator of the overall health of the US economy.