Peter Steele, head of Client Relations at Seneca Partners looks at what paraplanners need to know when researching Enterprise Investment Schemes and how they can help clients use EIS within their tax and financial planning.

How has EIS evolved in recent years?

Broadly speaking, EIS investing took a different turn for many investors with the advent of the Patient Capital Review and UK government’s change in legislation in 2018, to ensure that tax reliefs were made available to investors in young, growing businesses that might otherwise struggle to raise capital to fund their growth. Rules were significantly tightened to ensure that tax reliefs were being used to support companies where there was a genuine risk to capital and not purely as a tax mitigation tool for high earning individuals.

Risk for investors

Young, growing companies are the backbone of the UK economy creating employment and future prosperity and many of the ‘star companies’ of today had their origins in EIS. Of course, young businesses often have great business ideas or innovative products but with little wool on their backs, often struggle to obtain funding from banks and other financial institutions. In making very attractive tax reliefs available to private investors for backing these companies, EIS has become a mainstream in promoting growth within the UK economy.

In terms of risk at investor level, investing in a business very early in its life cycle would invariably mean being at the higher end of the risk spectrum – the very reason for tax incentives being made available. This may be even more relevant against the backdrop of the Covid pandemic and war in the Ukraine as cash resources, supply chains and turnover have all come under pressure but as always, dislocation within the economy often spawns opportunities. A number of young businesses have been able to thrive in recent months with biotech, technology and businesses with healthy cash runways amongst them.

Does EIS carry the same attraction for investors in difficult economic times?

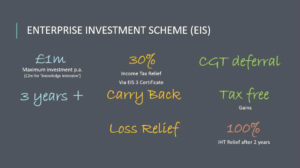

It is worth highlighting the different circumstances faced by investors and the principal advantages EIS can provide.

30% initial income tax relief is a considerable benefit, and even more so if there are capital gains to defer alongside. The ability to carry back to earnings made in the 2021/22 tax year as well as the current tax year is also very attractive to investors.

With specific reference to the risk question, the initial tax relief and the additional ability to claim loss relief if things don’t reach fruition goes a fair way to cap the level of any losses for investors. The headline of 30% initial income tax relief combined with any gains made being tax free also stand up favourably against current interest rate yields from investing in the perceived less risky investments.

Often, it will be for investors and their advisers to decide whether CGT deferral is the driver for using EIS or simply income tax relief, however it could be both. In many of our own conversations with advisers, it is important to stress that EIS investments ought to be considered on their merits as a component within an overall investment portfolio rather than as a stand-alone product which is used purely for tax purposes. Assuming investors are sensible with how much they commit, then EIS as a small exposure to private equity type investments could have a relevant role to play and can provide very good returns as a reward for risks taken.

What are the next steps?

There are many good EIS products available in the market, with a wide variety of sector themes. Therefore, it will be a matter for investors to choose where they think the best growth prospects reside.

Equally, investors will be able to choose between single company investments, EIS funds or an EIS Portfolio Service of different companies offering to diversify subscription across several qualifying companies in different sectors. Diversification via a portfolio is very popular as a hedge against having all eggs in one basket. The failure or underperformance of a single company investment offers no alternative prospect of recovery, whereas a portfolio spread theoretically could do.

Due diligence is vitally important for investors to understand how their subscriptions will be deployed and more pertinently, when it will be deployed. This is an essential part of being able to claim tax relief against the income year that you wish to. Time and again, investors scramble around shortly before the tax year end and experience tells you that doing so is more likely to be about simply claiming tax relief and less about careful consideration of the investment rationale itself.

Many of the better known and longer standing EIS managers will be working on their pipeline of investable opportunities already and working through detailed due diligence on the investee companies.

The advice to any prospective EIS investor is to plan well ahead, research the EIS open offers and what the investment strategy is for each one. It is perfectly reasonable to speak with the respective manager and check out where your money is likely to be invested.

It is highly recommended that investors plan their investment well before the end of the calendar year to get more certainty rather than risk the potential lottery of not being able to access the fully subscribed offers and enter the pre-tax year end melee.

What might impact EIS this year?

Fundamentally, the inherent features of the EIS remain unchanged and to that extent offer clear attractions to investors when used in appropriate circumstances and within sensible asset allocations. It would however be expected that the wider economic issues arising from the effects of the pandemic and more recently the impact of the war in Ukraine may cause some investors to pause for thought.

The more relevant question is where the best growth opportunities will lie. This is the crucial point for investors having decent visibility on where their funds will be invested. Clearly, there will be companies in need of further funding to support their growth plans and as long as the case for doing so is backed by good evidence that their businesses remain in good shape, then that has obvious credence. The ones to avoid will be businesses which continue to struggle and have little or no cash runway to carry them forward.

Equally, a manager who is able to articulate the strength of new opportunities in their pipelines which are well positioned to flourish against this backdrop will be much sought after by investors.

Above all though, choosing a manager who has a strong track record of profitable exits with the return of cash to investors is crucial.

Striking this balance will be of utmost value in shaping the eventual outcome of your investment. Taking the time to explore this with managers who have a good EIS investment history and who feature on your list of potential ‘homes for your money’ would be a wise move.

[Main image: hello-i-m-nik-MAgPyHRO0AA-unsplash]