Four VT Chelsea funds of funds marked their 5-year track records in June, including the top performing monthly income fund. Rob Kingsbury spoke to the team behind the funds about their performance, investment strategy and view of the current market.

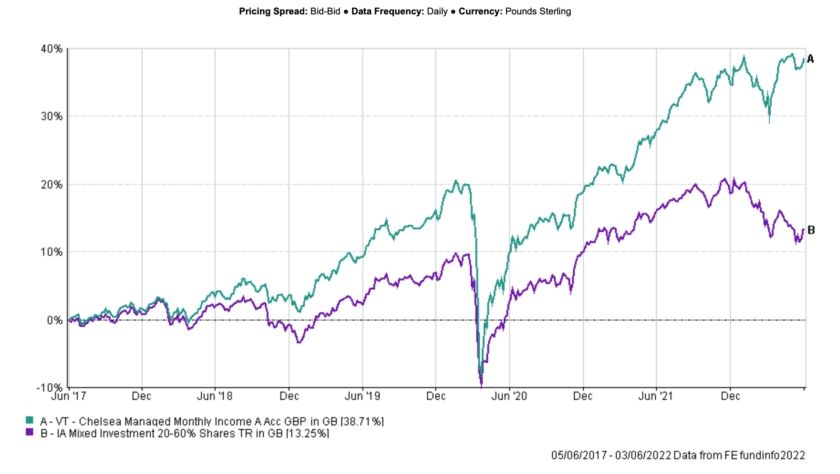

The VT Chelsea Managed Monthly Income fund marked its five-year track record in June as the best-performing fund in its peer group, the IA Mixed Investment 20-60% Shares sector, returning 38.7% against the average of 13.3%, according to FE Fundinfo.

The fund has been consistently in the top five funds in the IA Mixed Investment 20-60% Shares sector over 1, 3 and 5 years. Since launch it is number one. It paid a yield of 4.78% for the last 12 months to the end of June – with growth in income of 14.9% since launch.

It is one of four fund of funds launched by Chelsea, the sister company to Fund Calibre, in June 2017. The VT Chelsea Managed Cautious Growth fund returned 24.8% over the five years; the VT Chelsea Managed Balanced Growth 36.3%; and the VT Chelsea Managed Aggressive 40.9%*.

A team of three – Darius McDermott, Juliet Schooling Latter and James Yardley – who between them have over 60 years fund research experience, are the investment advisers. The funds were originally launched for Chelsea’s consumer clients who did not want to build their own fund portfolios, preferring a managed fund of funds instead.

As retail funds, they are available to financial advisers and their clients but McDermott says to date Chelsea has not actively promoted the funds to the market while building its track record.

On launching a fund of funds, James Yardley says: “We were conscious that fund of funds have a reputation for being expensive and our clients are very cost conscious, so we strive to keep our charge as low as possible, through fund costs, trading funds and trading opportunities – our AMC is just 0.3%.”

The investment advisers are fully transparent in where they are invested, including the weightings of each holding, details of which are published on the website. While the bulk of the investments are open ended funds, they use a number of investment trusts to help generate returns for the funds.

“Some trusts currently are trading at decent discounts,” McDermott says. As examples, during the pandemic the fund invested in a digital infrastructure trust, and a top 10 weighting in the Cautious, Balanced and Income funds is the Greencoat UK Wind trust. “The fund derives income from two sources,” McDermott explains. “The first is from government subsidies, which are RPI linked, and the second is from the sale of energy, and is delivering 5%+ yields growing with inflation.”

The fund looks globally and across asset classes for opportunities. “Currently, markets are tough,” McDermott admits. “It is difficult to find good things to invest in. Traditionally uncorrelated assets have all gone down together; so old-style equity/bond portfolios aren’t working, bonds have crashed, gold has struggled and index-linked gilts, which are supposed to be a safe haven in inflationary period, are a disaster.”

“We’re seeing a divergence between the US and the UK/Europe, due to the Fed taking bolder action on inflation, whereas, frankly, in the UK/EU the central banks have been asleep at the wheel,” adds Yardley. “The Bank of England can’t cut rates to improve the economy as they have to support the pound, as a weaker pound will lead to the UK importing inflation. We see little chance of a soft landing.”

A theme the investment advisers do like, McDermott says, is big tech. “It’s a long-term play; they are profitable and not expensive, profits are real and not just multiple expansion, and they have fortress balance sheets, high in cash and with little debt. It’s also possible to find investments trusts invested in big tech companies which are trading on 10-15% discounts.”

Areas to avoid at least short-term, McDermott suggests, are investments with exposure to the consumer and which are over leveraged.

* Source: FE Fundinfo, total returns in sterling, 5 June 2017 to 5 June 2022.

VT Chelsea Monthly Income – June 2017 – June 2022