Supply side reform and a dovish central bank make the UK one to watch in 2025, says Alan Dobbie, Rathbone Income Fund Manager.

Despite significant progress on inflation, the Bank of England (BoE) still thinks it’s too early to declare victory. While the bank’s interest rate-setting committee is confident that inflation will continue to fall back towards its 2% target in the coming year, it also flagged that energy costs will cause another summertime surge in the price level.

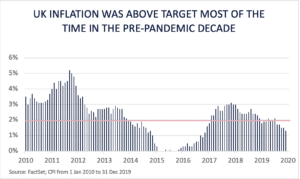

While much attention continues to be devoted to the UK’s inflation problem, we shouldn’t lose sight of the remarkable fall in the rate of CPI inflation over the past couple of years. At the end of 2024, UK CPI was 2.5%, down from 10.5% two years earlier. A few years ago, inflation readings of around 2.5% barely raised an eyebrow. In fact, in the decade leading up to the pandemic, inflation was above 2% fully 60% of the time. Indeed, when CPI broke through the 3.0% barrier in late 2017, the Bank of England meekly nudged its base rate up a quarter-point to 0.5%.

We also shouldn’t forget that inflation is a global issue – not something that the UK alone is fighting. Though the BoE cut its benchmark interest rate to 4.5% in February, it remains the joint highest in the G7 alongside the US. Meanwhile, UK inflation is below America’s, Japan’s and the combined Eurozone’s.

Restrictive rates, combined with a government unwilling to pass up an opportunity to highlight the dire economic situation it inherited, meant the UK only narrowly avoided recession in the second half of 2024. Yet more optimistically, could this all be about to change? After months of both the government and the central bank having a foot planted on the brake, could they be about to simultaneously switch to the accelerator?

Giving it both barrels

The Government has started 2025 with a remarkable shift in communication strategy. Talk of fiscal black holes and tax hikes have given way to a ‘growth trumps all else’ mantra. As if to demonstrate her seriousness, Chancellor Rachel Reeves has brushed aside Nimbyist and Net-Zeroer concerns by throwing a third runway for Heathrow back on the table. Deputy Prime Minister Angela Rayner has emphasised that people, not newts, will be prioritised when it comes to getting new housing through the UK’s sclerotic planning process. In a Times article, Prime Minister Keir Starmer even invoked Margaret Thatcher as he promised to “cut back the thickets of red tape” holding back growth. It’s fighting talk! Could it revive animal spirits and boost growth? It’ll take more than words, but from a very low base, it may not need much.

At the same time, the BoE could well be shifting towards a more dovish posture, concerned that high interest rates could be doing more to harm growth than tame inflation. Swati Dhingra, a consistently dovish member of the monetary policy committee, recently told Bloomberg that the BoE’s restrictive stance was “weighing on living standards, on supply capacity and investments”. She voted for rates to be cut by 0.5% in February. More surprisingly, arch-hawk Catherine Mann voted the same way. Her sudden volte-face suggests she’d like to see the committee take a more activist approach.

However, economists are not yet on board with this view. Most expect just three further quarter point cuts this year – not exactly the shock and awe Mann hopes for. Given that interest rates are often said to take the escalator up and the elevator down, we are alive to the risk that rates are cut more quickly than many expect. As long as it doesn’t accompany a deep recession, that tends to be very good for stocks.

Rate cuts to bolster housebuilders, property and households too

So, which areas of the UK equity market would benefit most from a faster pace of rate cuts and a growth-focused government? Two sectors stand out to us.

Housebuilders seem an obvious winner. Mortgage affordability is the big driver here, and the past few years have been very difficult indeed. As rates start to fall, that should ease the burden on families and make buying a home more manageable. The planning system is the housing sector’s other Achilles’ heel. While few sector-watchers gave the new government’s ‘mission’ to reform planning much hope, early signs of action are positive. Changes to the National Planning Policy Framework (NPPF) have gone down reasonably well, housebuilder management teams highlight a change of sentiment within some local authorities and Deputy PM Rayner has already approved several projects which have spent years stuck in the logjam. It’s early days but there are reasons to be optimistic.

Another sector we’d highlight is specialist REITs (Real Estate Investment Trusts). The so-called ‘Beds, Meds and Sheds’ of student accommodation, primary healthcare properties and logistics/self-storage operators would benefit from a faster pace of rate cuts and government growth initiatives. Not only are many of these companies highly indebted (so would benefit from lower interest payments), but their long-duration cashflows – generated many years in the future – would be worth more in present-day terms if the risk-free discount rate falls. A planning system with a presumption in favour of development rather than against would also help with pipelines for new sites.

Another benefit of falling borrowing costs is that tightened mortgage affordability tends to constrain demand throughout the economy. As more money goes towards servicing the mortgage, there’s less for new cars, meals out, holidays and investing – whether in a new business or stocks on the exchange. If that starts to reverse, it should turn the nozzle on more household spending and – perhaps – more investment flows from Brits. There’s precious little optimism priced into UK markets. We think that’s a big opportunity for investors.

Note: Any views and opinions are those of the investment manager, and coverage of any assets held must be taken in context of the constitution of the funds and in no way reflect an investment recommendation. Past performance should not be seen as an indication of future performance. The value of investments may go down as well as up and you may not get back your original investment.

Main image: kristina-gadeikyte-Mdx7XqEJ4ig-unsplash