Juliet Schooling Latter, research director, FundCalibre, continues her series looking at funds at or near a three year track record, by dissecting the Brown Advisory US Flexible Equity, concluding it is “a strong candidate for those looking for a core US equity offering”.

Accounting for more than 40 per cent of the $125 trillion global equity market cap*, US equities are comfortably the deepest and most liquid market in the world.

In theory, that should mean plenty of opportunities across the board. However, the reality is it’s also one of the most efficient markets in the world, with scores of analysts covering companies with a fine-tooth comb.

The past decade or so has only added to this. Growth has dominated, with a handful of mega-caps becoming a staple of any US investor’s portfolio. In short, while we as an investment team have always felt that small and mid-caps are the best place to be for long-term performance across the globe, the opposite has been true in the US.

And, with such deep analyst coverage, you can see why some prefer simply to invest in a tracker. But we strongly believe active is the place to be, particularly when markets have been as tumultuous as they’ve been in the past 24 months.

Finding funds with long-term outperformance of the S&P 500 is very difficult – so the fact that this month’s fund has been doing so for 25 years really makes it stand out from its peers.

The Brown Advisory US Flexible Equity fund was made available to UK retail investors in 2016 and manager Maneesh Bajaj took sole control of this fund in 2019, having stepped up to co-manager in 2017. He took over from industry veteran R. Hutchings Vernon (Hutch) who was a partner at the firm and had managed the fund strategy for more than twenty years. Needless to say, they were some big shoes to fill.

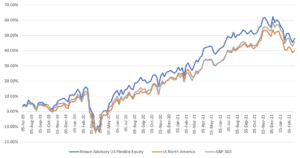

Fund performance over three years under new manager

Maneesh looks for favourable business economics, enduring competitive advantages, positive industry dynamics, capable and trustworthy management and sensible capital allocation. He avoids companies that have excessive financial leverage, business or product obsolescence, business and accounting complexity, excessive compensation, misaligned incentives or management hubris and no profit history.

He also uses a flexible strategy, with a bias to value but also looking for growth opportunities. He mainly seeks out undervalued medium-to-large improving businesses, which reward the fund with good liquidity and decent growth prospects. He invests in a wide universe of US stocks and has a low turnover. Companies with management change offer particular appeal.

Every idea is championed by a ‘lead analyst’ – either a sector analyst, a flexible equity strategy analyst or a flexible equity portfolio manager – who performs a financial statement analysis; competitive position evaluation; management interviews and site visits; and cross-checking with competitors, suppliers, industry contacts and sell-side analysts.

The lead analyst publishes his or her recommendation internally and includes a full description of business, economics and likely capital allocation going forward; a model to promote a thorough understanding of the desirability of business economics and to provide upside/downside valuation framework; and an explanation of the bargain moment – basically why the team should invest now!

Maneesh then evaluates these inputs to make a portfolio decision. He will ask questions like how a stock’s risk/reward characteristics compare to other holdings, to what extent business risk should limit position size and what economic concentrations will result from the purchase.

There are usually between five and 10 new positions per year in a portfolio that generally holds 40 stocks. The stock selection check list includes a price target to make 40–50 per cent over two to three years; a bargain moment trigger; a change in management, industry conditions or incentives; and a belief that the stock is overlooked, undiscovered or misunderstood.

The stocks under consideration have a minimum market cap of $2 billion, sufficient liquidity, and a listing on US stock exchanges, including American depositary receipts. The top ten holdings currently account for over 40 per cent of the fund, with Microsoft (6.7 per cent), Alphabet (6.6 per cent) and Mastercard (4.8 per cent), the largest individual positions**.

Since Maneesh took on the lead manager role in July 2019, its success has continued, even through some difficult markets. The fund has returned 47.9 per cent vs 45.9 per cent for the S&P 500 and 39.9 per cent for the average fund in the IA North America sector***.

Strong conviction in both process and, ultimately, stock selection has enabled this fund to consistently deliver for many years now and it is continuing to do so under its new manager. As a result, we believe this is a strong candidate for those looking for a core US equity offering.

*Source: Sifma.org – January 2022

**Source: fund factsheet, January 2022

***Source: FE fundinfo, total returns in sterling, figures from 28 June 2019 to 25 February 2022

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.