The UK may have reached a ‘tipping point’ with an accelerating exodus of wealth in the wake of Chancellor Rachel Reeves’ Autumn Budget, says Utmost Wealth Solutions.

According to Marc Acheson, global wealth specialist at Utmost Wealth Solutions, many high-net-worth individuals, particularly resident non-doms or those who have been UK resident for more than four years and UK domiciled, have already left or are preparing to leave.

One of the primary motivators for non-doms and their families leaving the UK since the October 2024 budget is the erosion of IHT protections on existing settlements, he says.

“Many accumulated their wealth prior to coming to the UK and were able to shelter it under previous structures. With the removal of these protections on existing trust structures, they face IHT on an ongoing basis, both on the assets settled within the trust and upon leaving the UK,” he explains.

“Additionally, if they have been UK resident for 10 years or more, any remaining assets in their estate will be subject to a 40% IHT charge upon death. IHT at 40% really does make the UK an outlier compared to other jurisdictions.”

Acheson said that while not everyone can leave the UK right now, particularly those with children still in education, they are actively restructuring their wealth to mitigate the changes while they remain here.

He continues: “Crucially, no one publicly has suggested that these changes will result in them extending their time in the UK, so people are likely to leave at a greater rate than average in the coming years. The new Foreign Income and Gains regime, which allows people to bring offshore income and gains into the UK tax-free for four years, only serves those who don’t intend to stay in the UK long term.

“Without meaningful reversals or adjustments, the risk is that wealth will exit the UK permanently and it’s hard to see currently where we are attracting new wealthy individuals from.”

Acheson’s outlook comes ahead of the Government’s spring statement and growing speculation that the Chancellor could make more substantial announcements on tax and spending than previously expected, following disappointing GDP figures.

“The figures showed the UK economy contracted in January before the full effects of the rise in business taxes have even been felt and the Bank of England and others have downgraded forecasts. Any headroom the Government had to meet its fiscal rules is now likely to have evaporated. As a result, to meet the tight fiscal rules the Chancellor has set, she may be forced to make more substantial announcements on tax and spending and turn the Spring Statement into an unwanted budget.

“However, if she decides to stick to her pledge to have just one fiscal event each year, she may promise action in the Autumn to ensure the rules are met. Yet that could lead to months of speculation and uncertainty,” Acheson added.

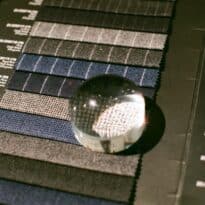

Main image: kelly-sikkema-kxtB2TFBF2g-unsplash