Advisers with NHS clients may need to be on hand over the coming weeks to guide them through the most recent delays to the McCloud remedy, and the impact this has on their retirement income, Justin Corliss, technical and pensions expert at Royal London explains

When public sector pension reforms were introduced in 2015 (2014 for Local Government Schemes) in the wake of the Hutton Report, the concessions given to those nearest to normal retirement age of their scheme were later found to be unlawful on the grounds of age discrimination and required rectification. This rectification process is commonly known as the “McCloud Remedy” and for those in scope of the remedy, it consists of two broad processes.

The first, or ‘prospective’, part completed in April 2022 and involved moving all active Public Sector Pension Scheme members into the reformed 2015 version of their scheme, meaning there was no further discrimination past that point.

The second ‘retrospective’ part of the remedy looks to correct the discrimination some scheme members experienced between 2014/15 and 2022. For members of unfunded public sector schemes, part of this involves members deciding whether they want benefits accrued during the ‘remedy period’ (2015 – 2022) to apply to their most recent legacy final salary scheme, or the reformed 2015 scheme. For active members, this decision is made when they take benefits, which will be at the point of retirement for most people. However, those in scope who have retired and taken benefits, or passed away, since 2015 are referred to as immediate choice members. As the name suggests, these members or their personal representatives need to make a choice as soon as possible, as their benefits are already in payment.

Delay announced

To facilitate this, Remediable Services Statements (RSS) outlining what the two options would provide regarding pension benefits, were due to be issued “on or before 1 April 2025 or by such later day as the scheme manager considers reasonable in all the circumstances in the case of a particular member or a particular class of member.”

Many retired members and dependents of those who have already died have been eagerly awaiting their RSS in order to make their McCloud decision. However, an announcement by Karin Smyth, Minister of State for Health on 31 March 2025 announced a delay in NHS Business Services Authority providing these for NHS scheme members in England and Wales.

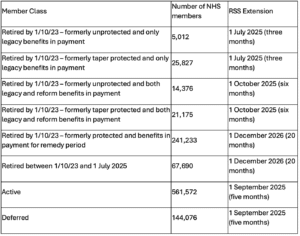

These extended deadlines for provision of the RSS, range from 1 July 2025 to 1 December 2026 for different groups of scheme members. The statement advises that “The revised delivery plan prioritises members based on their likelihood of facing financial detriment as a consequence of the discrimination.”

Impacted members

So, let’s unpick what this delay can mean in practice. Using the example from the top row of the table, this client is in scope of the McCloud remedy, moved to the reformed scheme in 2015 (hence the description as an unprotected member), but has since retired and put only their legacy scheme benefits into payment before rollback occurred in October 2023. So only benefits accrued up to 2015 are in payment, as from that point on they were accruing benefits in the reformed scheme. They may have wanted, perhaps even needed, the income from the reformed scheme benefits but left them uncrystallised as it may have resulted in an actuarial reduction due to being taken prior to scheme normal retirement age. This is state pension age in the reformed scheme, but earlier in the 1995 and 2008 sections of the NHS pension scheme.

Once they receive their RSS, they will be able to make a choice whether they want the period from 2015 to 2022 (or as much of this as they were in service for) to be treated as having been accrued in the legacy or reformed scheme. Those choosing legacy scheme benefits would then see an immediate increase in benefits being paid, as their entire pension now falls into the legacy scheme with an earlier normal pension age.

So, this delay will be disappointing news to affected scheme members hoping they would be able to increase their income as soon as possible. It’s important the deadlines aren’t extended any further, so affected members can make plans with a degree of certainty. There are other factors to consider, aside from highest member benefits, and many will need the assistance of specialist advisers to ensure they make the decision best suited to them. Here I have outlined the position for England and Wales, although the Scottish Public Pension Agency have also announced delays to the provision of RSS. So, advisers with clients who are NHS pension scheme members impacted by these delays may want to reach out to them to discuss any changes this means to their financial plans.

Main image: national-cancer-institute-NFvdKIhxYlU-unsplas