The Autumn Statement has been met with a mixed reception by self-directed investors according to new research from the wealth manager, Charles Stanley.

The highly anticipated Budget, which saw the Government take measures to raise tax and increase spending, succeeded in not causing market panic at the outset, though the longer-term effects of the changes to the UK economy remain to be seen.

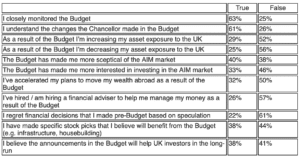

When asked whether they believe the announcements in the Budget will help UK investors in the long-run, respondents were almost split down the middle, with 38% of investors believing it will, and 41% believing it won’t. Slightly more investors said they would increase their asset exposure to the UK as a result of the Budget than would decrease their exposure: 29% to 25%.

The research also reveals that the Budget has already changed investor behaviour. Almost two-fifths (38%) of self-directed (DIY) investors say that they have already made specific stock picks that they believe will benefit from the Budget.

Tellingly, a third (32%) of investors say they have accelerated their plans to move their wealth abroad as a result of the budget.

A further third (33%) say that the Budget has made them more interested in investing in the AIM market.

Regardless of its impact, the UK’s DIY investor community has a close eye on the Budget. Almost two thirds (63%) monitored it closely. However, 26% don’t understand the changes made, and a further 13% weren’t sure – 61% did.

Rob Morgan, Chief Investment Analyst at Charles Stanley Direct, said that gauging the reaction of self-directed investors to the Autumn Statement “gives valuable insight into its reception by those who have a direct stake in the country’s economic success. Our research paints a picture of doubt: while many investors’ confidence in the country remains intact, a larger proportion are less ebullient, and this could have a knock on effect on the value of UK equities.

“The longer-term effects of the Budget on the economy will become clearer with time; as always, we advise investors to stick to the principle of investing for the long-term, with a diversified portfolio, and to seek professional advice before making major financial decisions.”

Main image: ana-municio-PbzntH58GLQ-unsplash