Drawdown clients or those approaching retirement should be careful not to panic or make rash decisions following the sharp Coronavirus-driven sell off across global markets, says Quilter’s head of retirement policy Jon Greer.

Greer explains: “In the years since the crisis, investors have enjoyed bumper returns that have bolstered retirement pots. It means that despite the recent slump in capital markets, drawdown investors approach this from a position of strength. Doing nothing may seem counterintuitive but investors can be their own worst enemy in terms of strife.”

Following the outbreak of Coronavirus at the start of the year, financial markets have fallen sharply. The FTSE 100, Dow and S&P 500 suffered their worst day since 1987 earlier this month, sparking fears of a global recession.

While there can be a temptation to flee into cash when markets fall, Greer says clients should be reminded that losses in a portfolio aren’t locked in until the assets are sold. If investors remain invested, there is the opportunity for them to recover.

However, clients should consider whether reducing withdrawals is possible, particularly those with smaller pots who need to focus on the longevity of their retirement savings.

As an example, if a client with £100,000 pot has a withdrawal of 4%, this would normally equate to £4,000 per annum. However, if the pot has fallen in value to £75,000, taking £4,000 would mean a withdrawal rate of 5.3%.

Income today or income tomorrow

Greer says: “To mitigate the risk of ruin, they could keep their withdrawal rate fixed at 4% to preserve the longevity of their pot, although this would see the income from their pension drop to £3,000 a year. This is a difficult decision and individuals need to decide whether they are willing to forego some income today in exchange for greater income security in the future.”

Greer suggests taking income from dividends and other assets where possible, to help avoid the ‘pound-cost ravaging’ process where more investment units are sold to generate a desired income level in declining markets, depleting the portfolio size during the early years of drawdown.

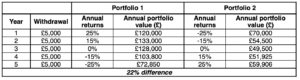

He says: “When you are in drawdown the sequence of your investment returns is of vital importance. A retiree with a portfolio of £100,000, taking annual withdrawals of £5,000, could be 22% worse off if they experienced losses in the first two years of retirement, compared to having these same losses in years four and five.”

One way to avoid this, according to Greer, would be to take income from the dividends and bond payments that underlying investments provide. Additionally, as some companies suspend or scrap their dividends altogether in the wake of the crisis, it is important clients mitigate some of this risk by having a diverse income stream, such as infrastructure investments, and do not rely solely on a few large dividend paying UK businesses.

Clients could also utilise other assets such as cash ISAs in the medium term while markets recover, which may allow them to pause or reduce their pension income withdrawals.

Greer also recommends making further pension contributions where possible, although advisers should check clients’ annual allowance.

Finally, for those clients not yet in retirement, delaying the end of work may help ease the financial burden.

Greer adds: “Shaving a few years off your retirement date removes the immediate term worries about cashing in your investments to generate income during a dip in the market. By delaying retirement, investors may be able to side-step the sequence of return risk to some extent.”

Returns of a £100,000 portfolio over five years