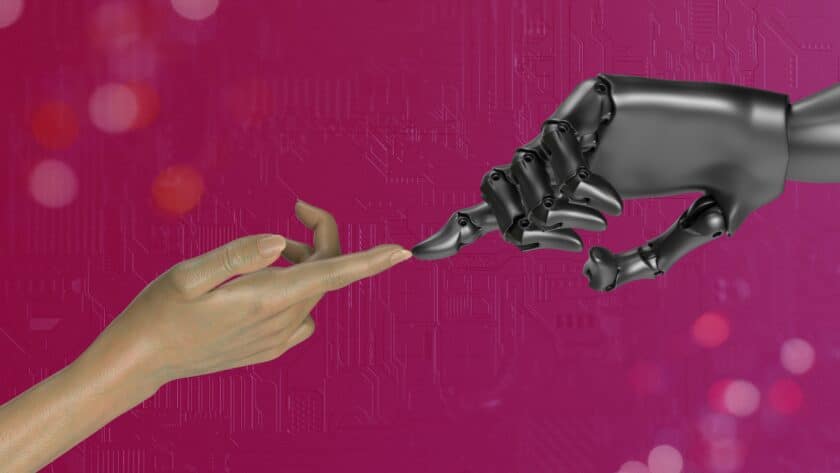

Human advice remains in greater demand than artificial intelligence, new research from Unbiased has revealed.

According to the advice platform, three quarters (74%) of those seeking financial advice are open to an adviser-led model, compared to just 6% who would choose an AI platform alone.

Its research found that 40% would only be open to a human adviser, while a further 34% said they would be open to a human adviser using AI tools.

Trust and personal connection were cited as the main reasons for preferring human advice.

At the same time, the data also highlighted significant consumer mistrust and fear around AI. A quarter (25%) cited a lack of human oversight, while 23% raised concerns around the risk of poor or inaccurate advice. A fifth (19%) also flagged concerns around data privacy and security.

However, Unbiased said there is a role for AI in supporting functions, with respondents listing benefits such as lower costs (24%), faster support (21%) and 24/7 availability (18%).

People were also more open to AI for tasks like adviser matching (23%), answering general financial questions (21%), or producing personalised reports or summaries (18%).

Tim Grimsditch, managing director at Unbiased, said: “This research shows what many in the industry already sense: people want the human touch in financial advice. Trust and personal connection remain paramount, especially for life-changing financial decisions.

“At the same time, there’s clearly an acknowledgement of AI’s ability to play a supporting role – helping with efficiency, cost, and accessibility. The future isn’t AI instead of advisers, but advisers enabled by AI.”

Main image: igor-omilaev-gVQLAbGVB6Q-unsplash