Paul Ilott, Managing Director, Scopic Research, looks at reasons paraplanners might want to blend multi asset portfolios together, and highlights some of the actions to avoid when doing so.

As a multi asset research specialist I’ve come across a great many adviser firms that like to blend multi asset funds together into one client portfolio. Sometimes this is done for additional ‘diversification’ purposes to reduce reliance upon a single multi asset fund, and sometimes it’s simply to recognise the fact that there are clients who have a number of different investment objectives that might be more straightforwardly achieved by assigning a different multi asset fund to each of them. But, whatever the motive, there are I believe, some things to avoid.

Over diversification

On occasions I’ve seen up to seven different multi asset funds being held in one blended portfolio. This destroys alpha by introducing inefficiencies, increases duplication and complexity, and potentially lowers risk adjusted returns. And of course, it can sometimes exert upward pressure upon costs.

Relying on past performance

Combining multi asset funds that have all performed well in recent years is particularly problematic. Doing so can mean that they all share some of the same embedded biases (at Scopic we call this a multi asset fund’s DNA) that have helped to drive their returns. This can still be the case even if the chosen multi asset funds don’t offer access to the same mix of underlying product structures – such as direct securities, passives, investment trusts, other funds, derivatives, or even combinations of some or all of these. The real risk is that choosing to blend multi asset funds that have all performed well in recent years might mean that at some point they will all perform poorly at the same time. The return of inflation during 2022 is a case in point.

Ignoring style

Just as single strategy funds can exhibit biases towards certain investment styles, sizes of company within their equity allocations, and other embedded biases – so can multi asset funds (it’s that DNA again).

The make up of the DNA can have a significant bearing on how we might expect an individual multi asset fund to perform during different market scenarios in comparison to those peers that might have rather different embedded biases (DNAs). Some multi asset funds do have the scope to be able to flex all of these characteristics – we would call this being macro-view aligned – where the team has a great deal of freedom to reflect its macro views directly onto the fund’s investments and positioning. Others seek to blend away embedded biases (although of itself this trait is an embedded bias of sorts), whilst others retain their distinct DNAs throughout the cycle. Either way, we can use the DNA to build our own expectations of how individual multi asset funds might behave and the conditions under which one particular muti asset fund might be more likely to outperform another.

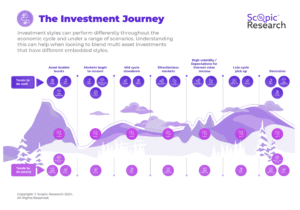

To see how this might play out during different market scenarios I’ve included a graphic below from the portfolio blending tool on our website showing a fictitious investment cycle that depicts how different investment styles, such as value, growth, and quality, as well as different capitalisation sizes, such as larger companies and smaller companies, might be expected to perform. These expectations might not always play out, but they quite often do.

An understanding of the differences in the DNAs of multi asset funds should go a long way towards creating, not only a more successful blend throughout the cycle – if that’s what you want to achieve – but also a greater tolerance for the different investment journeys of individual multi asset funds under a range of market scenarios.

I should point out that the embedded biases (DNAs) of more than 120 multi asset funds, together with qualitative based research analysis on each fund, is available to advisers for free at: www.scopicresearch.co.uk

The DNA also has key implications for consumer duty. Imagine being able to anticipate the conditions under which a multi asset fund is most likely to have a tailwind behind its returns or to face headwinds. If you like to blend multi asset funds, then blending those likely to have different tailwinds and headwinds is likely to prove more successful than relying on past performance and cost alone.

Main image: aneta-pawlik-mth4rzWf3dY-unsplash