Tax receipts suffered a sharp drop in April, as the consequences of the Covid-19 pandemic and lockdown took effect.

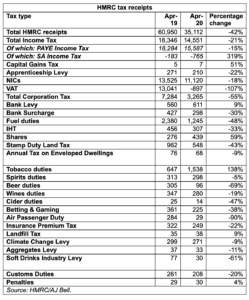

Figures released by HM Revenue & Customs showed the amount of tax taken by the government fell by 42% in April compared to a year ago, as unemployment rose, staff were furloughed and businesses used coronavirus schemes to defer tax.

Total HMRC receipts for the month reached £35.1 billion, down £25.9 billion on April 2019.

The biggest fall was in VAT, with the total tax dropping 107% year-on-year as companies deferred their payments to boost cashflow. Meanwhile, income tax receipts fell by 21%, while National Insurance payments decreased by 18%.

Closures across pubs and restaurants also hit the public purse, with beer duties down 69% in April, while a lack of travel caused a 90% drop across air passenger duty payments.

Laura Suter, personal finance analyst, AJ Bell, said: “The first sign of the lockdown crunch on the government’s tax take can be seen in how much tax the nation paid in April, which has fallen off a cliff compared to last year.

“The government faces a huge challenge ahead to deal with these falling tax receipts while also having to pay for its numerous support schemes during the current crisis. So far around £5.2 billion has been spent on the Coronavirus job retention scheme and it’s inevitable the public will see tax rises to help meet the shortfall.”