Fracture cover can differ markedly between providers and when seeking cover it will pay paraplanners to find out lifestyle details from clients, says Adam Higgs, head of Research, Protection Guru

Breaking a bone can be particularly painful. It can also lead to short-term income loss due to be unable to work particularly for those that are manual workers, self-employed or with limited sick pay from their employer. Whilst income protection may provide financial relief, the benefit start date of such plans will depend on the length of the deferred period. Fracture cover, however, will pay an immediate lump sum after a named fracture which could support clients that have long waiting periods.

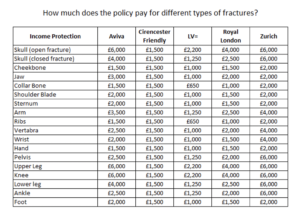

Currently there are five insurers that offer fracture cover either as an add on or built into their protection plan. LV= (not available on personal sick pay) and Royal London both offer this as standard within their income protection plan. Aviva, Cirencester Friendly and Zurich offer fracture cover as an additional add on to all plans at a cost of £4 per month (Aviva & Cirencester Friendly) and £6.90 per month (Zurich).

When it comes to broken bones, fracturing certain bones will be more debilitating than others and this is reflected in the amount each insurer will pay and the bones that are covered. Breaking a finger for example may not impact most clients drastically and such is not covered, however an open fracture of the skull may be more debilitating and all plans cover this with a higher payment.

Zurich, cover more than just fractures, however. Knee ligament tears, Achilles tendon ruptures and dislocations of the spine or hip, knee or ankle, shoulder, elbow or wrist and jaw or middle ear bones are also covered paying between £2,000 and £6,000.

Clearly the risk of suffering a broken bone are increased if a client partakes in hazardous pursuits. Whilst Cirencester Friendly and Royal London do not state any standard exclusions, Aviva, LV= and Zurich do. These include pastimes such as combat sports, horse riding, motorcycle sports and rugby among others. Where you are dealing with a client that takes part in a contact sport or activity that may be considered dangerous, I would encourage paraplanners to discuss this with the insurer to understand whether fractures caused by this are covered.

A broken bone may not cause a client to be off work for an extended period of time, but it may lead to short term income loss, particularly for the self-employed and those with very little sick pay. For such clients fracture cover may be a serious consideration, however paraplanners should be aware of any dangerous pastimes and check with insurers to see if they are covered.

A longer version of this article can be found on the Protection Guru website.