Jon Greer, head of retirement policy at Quilter, examines the effect of the Chancellor’s decision to freeze the pensions Lifetime Allowance until April 2026.

While everyone understands the precarious fiscal position the government finds itself in, changing the lifetime allowance once again adds even more complexity to the retirement planning process. The allowance has been kicked around like a football since its introduction back in 2006.

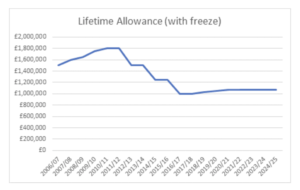

It was originally set at £1.5m as part of a plan to simplify pensions and replace a complex legacy of eight different tax regimes. It was a single number that established the maximum someone could build up their pension tax-efficiently, and was only supposed to impact a very small number of wealthy people. From there it was allowed to climb with inflation to reach £1.8m in 2011/12, before being lowered back down to £1.5m for 2012/13. In 2015, it was announced that the LTA would be cut from £1.25m to £1m from 2016/17 and tied to CPI from April 2018/19.

And now the allowance has been de-linked with inflation and frozen until 2026.

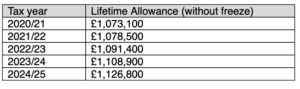

If it was allowed to continue to increase with inflation, it would have reached £1,078,500 in 2021/22 – a real terms decrease of £5,400 – before increasing to an estimated £1,126,800 in time for the next general election, nearly £54,000 more than will now be the case.

Figures obtained using the OBR November forecast for CPI inflation. Lifetime allowance rounded to the nearest £100.

Some will argue that freezing the LTA is justified because pensioners haven’t been as adversely affected financially by the pandemic than those of working age, and so they must pay their fair share of the costs.

What this view fails to appreciate is that the lifetime allowance is a test on entry into being a pensioner. Someone who became a pensioner before the pandemic isn’t going to face a lower LTA if their pension is already 100% crystalised and they are withdrawing an income. Freezing the LTA will mostly impact people in the workforce today who are forced into retirement because they lose their job.

Doctors will be among the hardest hit by the change, and the NHS could well suffer as a consequence as doctors may be encouraged to accelerate their retirement plans.

We’ve had the clap for carers, now we have the freeze for our frontline doctors. We know that the previous reductions in the lifetime allowance were linked to a number of doctors leaving the NHS, or reducing their hours significantly, because many doctors see the Lifetime Allowance as a cap to their pension and the point at which they should consider retiring or reducing their workload.

Figures from the British Medical Association shows that an astonishing 47% of GPs and hospital doctors were considering retiring early due to the Lifetime allowance, and that was before any changes.

To avoid this scenario, and to maintain simplicity of retirement planning, the Chancellor should consider ending the freeze during this Parliament, when fiscal conditions allow, to restore the link to inflation.