Delivering value is key to the FCA’s Consumer Duty paper but how can we define ‘value’? Nathan Fryer, director of Pan Works considers what it may mean in the context of financial planning

The consumer duty consultation paper CP21/13 talks a lot about fair value so I thought it would be useful to try to understand what value means and perhaps what the FCA are looking for.

The purpose of the paper is to promote a fairer, more consumer‑focused level playing field where consumers get the products and services they need, which are fit for purpose, provide fair value and do not cause them harm

The paper used the word “value” 349 times, which I think highlights the importance of what the FCA are trying to achieve with this paper.

Chapter 8 goes on to say,

“The specific focus of the price and value outcome rules is on the relationship between the price the consumer pays to the overall benefits they can reasonably expect to obtain from a product.”

“Value needs to be considered in the round and low prices do not always mean fair value. “

“We expect firms to think about price when assessing fair value but not at the expense of other factors. The price and value rules do not prevent firms with an innovative product that provides additional benefits to customers charging more for it. It is not our intention for the price and value outcome – or any aspect of the Consumer Duty – to hinder innovation.”

So what is value?

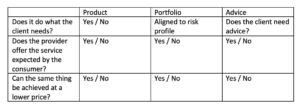

Value, in terms of financial planning and advice, can be considered as follows:

So if we take each segment in isolation:

Product

In this example let’s consider that the client needs a pension: Does it do what the client needs?

We need to consider what the Client needs from the pension. Are they of an age where they need to be able to flexibly access their pension and if so, is flexible access in the client’s interests? If the answer to these questions are no, then a pension that offers these features might not represent good value at this stage. However, if you can find a pension that offers these additional features at the same price as a pension that doesn’t, then I would consider this to be good value as the client has the benefit of being able to use these features in the future, should they need to.

Portfolio

This is rather more tricky and I would suggest it depends upon your investment philosophy. If your philosophy dictates that you are an advocate of active investment management, I would suggest that you would need to demonstrate that value within your CIP. Obviously, this would likely be backward looking.

I would suggest that providing you can demonstrate that the portfolio delivers the client what they expect and the cost is not excessive, then you can demonstrate value.

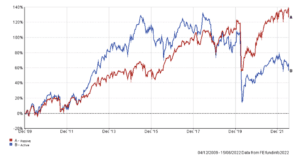

This is a chart of two funds in the UK All Companies sector, one is active and one is passive. The active portfolio costs 1.74%, whereas the passive portfolio costs 0.06%.

I think in this instance, you might struggle to demonstrate the value of the active fund over the passive fund, especially given the difference in performance over the period is 70%.

Over the past few years, we have seen a gradual shift from fully active to a blended or fully passive approach in many firms.

Advice

I think this will be the controversial point and I like to think of the value that advisers bring as peace of mind.

My analogy for this would be watching YouTube videos to learn how to change the engine in my car. This will be different for different people, but I for one, would not change the engine in my car after watching YouTube videos through fear of making things worse and the whole thing costing me a whole lot more money. This is the fear that consumers have when it comes to pensions. Guaranteed annuity rates, protected tax-free cash and flexible access drawdown could be likened to the components in a car. Whilst I have a basic understanding of an engine, if someone challenged me to change the clutch on my car, I would not have the first clue of where to start and this is the value that we as advisers / paraplanners all too often forget. We forget that this is our area of expertise.

This reminds me of a great story about a giant ship’s engine that failed, the owners tried many, many different things to try and fix it.

Then they brought in a mechanic who had been fixing ships since a young age.

The mechanic carried a large bag of tools and inspected the engine very carefully, top to bottom.

After looking things over, the mechanic reached into the toolbox and pulled out a small hammer. The mechanic gently tapped something. Instantly, the engine lurched into life.

A week later, the owners received an invoice from the mechanic for $10,000.

What?! the owners exclaimed. “The mechanic hardly did anything…!!!”.

So they wrote to the mechanic; “Please send us an itemised invoice.”

The mechanic sent an invoice that read:

Tapping with a hammer………………….. $2.00

Knowing where to tap…………………….. $9,998.00

The value that advisers provide is knowledge and the price that you put on that needs to offer value. The value in this example is the fact that the engine is now working. Some might consider the price paid to be unreasonable, but it depends upon what impact having that boat working might have on the owners.

So I think for advisers, we need to deliver a service to clients that imparts knowledge through implementation of a working plan. For me, that’s making sure that the Plan Works, is the value, not the time or number of pages in a suitability report.

This article was first published in the July/August 2022 issue of Professional Paraplanner.