This issue, the Brand Financial Training team turn their attention to the application of the Triple Lock on increases in the value of the State Pension.

For those who are relatively new to the pensions market, it might seem that the triple lock increase on the State Pension has been around forever. It is easy to forget that the three-pronged pay rise has, in fact, only been in existence since 2010, having been introduced by the Conservative/ Liberal Democrat coalition government under David Cameron.

The intention of the triple lock was to go some way towards ensuring that pensioners were not disadvantaged by seeing the value of their State Pensions eroded by inflation and that they were not getting poorer relative to people of working age. The triple lock basically provides that future increases in the State Pension are calculated with reference to three criteria:

- The increase in inflation, as measured by the Consumer Price Index, in the 12 months to the month of September prior to the start of the tax year;

- The increase in National Average Earnings year-on-year as measured during the May-to-July period immediately prior to the start of the tax year;

- A flat figure of 2.5%

The increase in payment would be based on the highest of these three factors. So, for example, the increase for the 2021/22 tax year was 2.5%. This was because CPI for the year ended September was just 0.5% and national average earnings for the period May to July 2020 were 1% lower than the same period the year before due to the impact of the Covid-19 pandemic. The 2020/21 tax year, by contrast, had seen the highest increase since 2012, a figure of 3.9% based on the rise in average earnings in the May-July 2019 period. This compared favourably with CPI at 1.7% and the flat 2.5%.

Note that, interestingly, in order to increase the pension at all for 2021/22, the government was required to table a Bill to amend the existing legislation. This stated that State Pensions could only increase if there had been an increase in national average earnings over the relevant part of the prior year. This would, in theory, have meant that the State Pension remained static during a period of falling average earnings.

There has been widespread speculation over recent years that the government intends to dispense with the triple lock on the basis that it is unaffordable. To date, such rumours have proved to be unfounded. However, for the 2022/23 tax year alone, the government has decided to reduce the triple lock to a double lock, meaning that it will be increased by the September 2021 12-month CPI figure of 3.1%.

The reasoning behind this was the previously mentioned fall in national average earnings to July 2020, which came about as a result of the number of workers losing their jobs or being furloughed during the Covid-19 pandemic, which caused an unprecedented drop in income levels. As the worst effects of the pandemic started to subside and life slowly started to return to somewhere near normal, businesses have reopened, those made redundant or furloughed have been reinstated or found new jobs and income levels have returned to those that existed pre-pandemic.

This has caused an unprecedented situation where average earnings to July 2021 had hit an astonishing 8.3% increase on the previous year. The government, however, felt that an increase of 8.3% was unjustifiable since once the effects of Covid were smoothed out, national average earnings were, in reality, only 7.2% higher than the figure of two years earlier. It has been reiterated that this is a suspension rather than an out-and-out scrapping of the policy, which is currently intended to be maintained at least until the end of the current parliament in 2024.

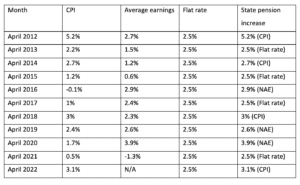

For your interest, the historic increases in the State Pension under the terms of the triple lock are as follows:

The mathematically minded may note that this gives an average increase over the period of just above 3% per annum, which goes at least some way towards maintaining a pensioner’s standard of living.

About Brand Financial Training

Brand Financial Training provides a variety of immediately accessible free and paid learning resources to help candidates pass their CII exams. Their resource range ensures there is something that suits every style of learning including mock papers, calculation workbooks, videos, audio masterclasses, study notes and more. Visit Brand Financial Training at https://brandft.co.uk

This article was first published in the February 2022 issue of Professional Paraplanner.