Insurer Zurich has launched a new tool to help streamline protection advice in the pre-application process for clients.

The tool, available through Zurich’s Life Protection Platform, has been designed to provide an instant indication on underwriting decisions before advisers complete full applications, reducing the amount of time for a decision to be given.

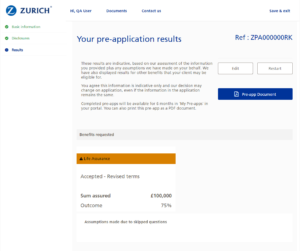

Advisers will be able to enter key information about clients including their age, nicotine usage and the required sum assured, while further information including medical history and lifestyle can also be entered for more accurate indications.

The insurer said all decisions will be saved in a dashboard with a unique reference number, allowing advisers to revisit and edit cases as needed. Where it’s likely a case will need to be referred to an underwriter, the tool will provide a range of indicative decisions, showing a minimum, maximum and expected outcome.

While the tool is equipped to support 90% of all current pre-application enquiries, Zurich will retain its telephone-based support.

Nicky Bray, chief underwriter, Zurich’s Life Business, said: “We’re on a constant mission to make applying for cover as simple and smooth as possible for both advisers and their customers. We know that misconceptions about cost and existing illnesses can be barriers to people taking out life insurance. We’re confident that by presenting advisers swiftly, with accurate information about all of the solutions on offer, we can challenge that view.

“We’re confident that by providing advisers with a self-service option that they can access around the clock, we’re supporting them in delivering the best possible service for customers. Ultimately, we’re keen to ensure that as many people as possible benefit from protection and the financial resilience it brings to them and their families.”

Jeff Woods, Sesame Bankhall Group, added: “This is great innovation and will greatly assist advisers to more easily, 24/7 set expectations with their customers as far as cost and cover is concerned. Zurich seem to be leading the way in digitising much of the customer and adviser process which is great to see.”