Online retirement specialist Guiide has taken the latest figures from the Office for National Statistics’ Wealth and Assets survey to help pension savers understand what steps to consider when saving for their future and how much they need for a ‘minimum’ to ‘comfortable’ retirement income.

By taking three of the key data points to create a typical retiree, Guiide has calculated how much people will need to achieve the various types of retirement lifestyles determined by the Pension and Lifetime Savings Association in its Retirement Living Standards study.

The findings from the ONS survey show that almost 60% of people expect to retire between the ages of 65 and 69 and anticipate needing an income until nearly 90. The vast majority (86%) expect to get the State Pension in their retirement.

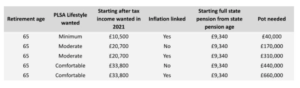

Using these findings, Guiide calculated how much retirees would need to fulfil the following lifestyles: minimum (inflation-linked); moderate (non-inflation linked); moderate – (inflation-linked); comfortable (non-inflation linked); and comfortable (inflation-linked). See table below.

Individuals seeking a minimum inflation-linked lifestyle will require a pension pot of £40,000, while those after a flat non-inflation linked moderate lifestyle will require £170,000. This figure jumps to £310,000 for retirees targeting an inflation-linked moderate lifestyle, Guiide said.

Meanwhile, retirees seeking a comfortable lifestyle on a non-inflation linked pension will need a pot worth £440,000, rising to £660,000 for those after a comfortable lifestyle on an inflation-linked pot.

Despite 45% of people surveyed by the ONS stating they were not confident about their future standard of living in retirement, Guiide says its own calculations mean that even those with a modest retirement pot will be able to support a minimum retirement lifestyle.

According to Guiide’s own findings, three quarters of people desire an inflation-linked income in their retirement plans . However, evidence shows that spending actually decreases in real terms in the later years of retirement meaning a flat income may be a preferable option for those with limited pension pots who desire a moderate of comfortable lifestyle in the early years of retirement, the group said.

Kevin Hollister, founder, Guiide, said: “Everyone is different, requires different income, has different elements to put towards this income and wants to retire at different ages. Whatever the individual circumstances, everything should start with building a plan to achieve a retirement goal. It’s never too later or early to build one to help a greater number of people become more confident in their retirement provisions.”

Kevin Hollister, founder, Guiide, said: “Everyone is different, requires different income, has different elements to put towards this income and wants to retire at different ages. Whatever the individual circumstances, everything should start with building a plan to achieve a retirement goal. It’s never too later or early to build one to help a greater number of people become more confident in their retirement provisions.”