Andrew Tully, technical director, Canada Life, looks at how quickly a pension pot could breach the LTA over the next five years.

The Chancellor of the Exchequer has confirmed the pension Lifetime Allowance (LTA) will be frozen at £1,073,100 until April 2026 in today’s Budget.

This measure simply sends the wrong signal to savers trying to do the right thing. It also penalises good investment performance. We already have annual limits on the amount you can save via a pension wrapper and there is a significant disparity between how defined contribution savers and those with defined benefit income are treated for lifetime allowance purposes.

Key points:

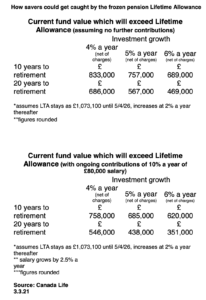

• A current pension pot of £469,000, with no further contributions, could breach the pension lifetime allowance in 20 years (if the LTA is frozen until April 2026 and then increases by 2% on average each year thereafter).

• A pension value of £1,073,100 today would secure an annual income of around £28,000 a year at age 65.

• The Chancellor forecasts to raise an extra £990m from the measure by tax year 2025/261

• A current pension pot worth £351,000, with ongoing contributions of 10% a year from someone earning £80,000 could breach the LTA in 20 years (if the LTA is frozen until April 2026 and then increases by 2% on average each year thereafter).

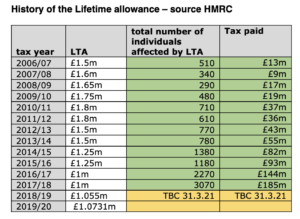

The lifetime allowance is an arbitrary tax which penalises DC savers. The last 10 years has seen the lifetime allowance fall from £1.8m to £1m; stay frozen at £1m; gradually increase by inflation; and now is frozen again. These continuous changes to pensions policy exacerbate the uncertainty many people feel around pension saving. Instead of constant tweaks we need stability to give people confidence to save for the long-term.

- Source: Budget21 Redbook, page 42 Pensions Lifetime Allowance: maintaining at £1,073,100 up to and including 2025-26 Tax -10 +80 +150 +215 +255 +300