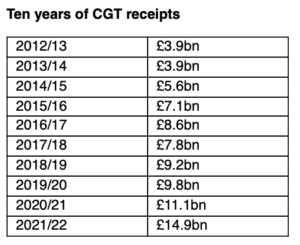

The amount of Capital Gains Tax collected by the government climbed by more than £5 billion in the past two years, official figures from HM Revenue & Customs have shown.

The government raised £14.9 billion in CGT receipts in 2021/22, up from £9.8 billion in 2019/20, as a result of rising house prices and changes to the tax.

Sean McCann, chartered financial planner at NFU Mutual, said: “The increase in Capital Gains Tax receipts is being driven by a combination of factors. In March 2020 changes were made to Business Asset Disposal Relief, which allows business owners selling all or part of their business to pay only 10% capital gains tax rather than the top rate of 20%.

“The amount of lifetime gains that qualify for Business Asset Disposal Relief was slashed from £10m to £1m, meaning business owners are paying 20% on more of their gains when they sell.

“The runaway property market over the past two years is also likely to have contributed. There is an 8% surcharge for those who dispose of residential property that isn’t their main home, meaning those disposing of buy-to-let property pay CGT rates of 18% and 28%.”

McCann said changing legislation has made buy-to-let investing less attractive and rising house prices have increased the gains of those choosing to sell up.

With the annual CGT exemption frozen until 2026 and inflationary increases in the value of assets, NFU Mutual believes the amount raised in CGT is likely to increase.

McCann added: “To mitigate the impact married couples and civil partners can transfer assets between them to utilise both annual exemptions, allowing them to realise up to £24,600 of tax-free gains each tax year.”

While the Office of Tax Simplification recommended aligning CGT rates to income tax rate and estimated it would raise £14 billion extra a year, the Treasury has so far refrained from acting on the suggestion.

However, McCann says that with rising inflation and a spiralling cost of living putting greater pressure upon the government, “it is possible the Chancellor could look at CGT rates in the autumn as a way of raising funds to help pay for other areas of support.”