Global internet companies are set for a quantum leap as the Coronavirus crisis accelerates digital take-up, say Winston Lum, senior portfolio manager and Jermyn Wong, head of Asia ETF Business Development and Product Development director, Nikko Asset Management

Global stocks have had a wild ride in 2020. The onset of the Covid-19 pandemic initially brought global financial markets to their knees, with the S&P500 dropping by over 33% in USD terms between February and March 2020. The sharp decline was followed by a swift rebound, with most markets clawing back a large part of their losses by the end of June.

Look more closely, however, and you will see that the severity of the impact has been asymmetric across industries. Internet stocks were relatively resilient between February and March, with the iEdge-Factset Global Internet Index dropping by 25% in USD terms. In comparison, airline stocks were among the hardest hit, with the NYSE Arca Global Airline Index falling by over 57%.

The internet sector continued to outperform on the rebound, with the index [at time of writing] almost 10% higher than its pre-Covid-19 peak. This comes as no surprise as internet companies are generally characterised by strong balance sheets with low gearing, short product cycles and relatively lean headcounts—granting them agility to navigate through trying times.

The dominance of the internet sector is not news to anyone: Facebook, Alphabet and Amazon are household names that have long been among the top five most valuable companies in the S&P500. But we believe that their position will be further reinforced in a post-Covid-19 world. Internet stocks are at the intersection of three major themes that are expected to reshape the world in years to come: e-commerce, online advertising and the Internet of Things (IOT).

E-commerce

The e-commerce subsector accounts for about 30% of the iEdge-Factset Global Internet Index. Major component stocks that derive the bulk of their revenues from e-commerce are Alibaba, Amazon, JD.com, eBay, Baidu, Pinduoduo and Z Holdings (formerly Yahoo Japan).

There is tremendous potential for e-commerce to grow if companies can shift consumer purchasing patterns to online purchasing channels. Bank of America Merrill Lynch estimates that global penetration can increase from 11% to over 25% in the long term. This will be supported by the following factors:

1. Large potential room for growth. E-commerce penetration is highest in South Korea and China. However, in 2019, e- commerce accounted for only about 25% of retail in South Korea and China, and even less in other countries—a testament to its tremendous room for growth.

2. Convenience and speed. Convenience has always been a selling point for e-commerce. Individuals can purchase their goods and services anywhere and anytime without visiting physical stores. With greater optimisation in supply chains, e- commerce companies will be able to reach consumers with greater speed.

3. Rise in online offerings. The number of goods and services exclusive to brick-and-mortar stores is diminishing. More and more of these items can be purchased online with greater convenience and speed.

4. Bridging the gap between in-store and online experiences. With the rise of online user-engagement tools such as augmented reality, the gap between in-store and online experiences will be narrowed.

5. Increased e-commerce customer loyalty. The growth in subscription models that are prevalent among e-commerce companies (e.g. Amazon’s Amazon Prime) is likely to give rise to long-term customer loyalty and retention.

Online advertising (social media and search engine)

The iEdge-Factset Global Internet Index will benefit from the secular shift to online advertising and rising share of digital advertisement spending as this sub-sector accounts for about 27% weight in the index. Major component stocks that derive the bulk of their revenues from online advertising are Alphabet (Google), Facebook, Twitter and Naver.

We believe that there is still significant runway for growth for advertising across social media (e.g. Facebook, Twitter) and search engines (e.g. Google). These platforms can provide a higher degree of advertisement targetability through deep analysis of consumer data and consequently this translates to higher conversion rates. Compared to traditional media, these platforms are also able to provide richer content (e.g. interactive ads) and generate online conversations, increasing consumer engagement and stretching the possibilities of advertising. A short-term revenue driver will be the 2020 US presidential election as total political advertisement spending is expected to hit USD 6 billion, with a large portion going to online advertisements on platforms such as Facebook, Google and Twitter.

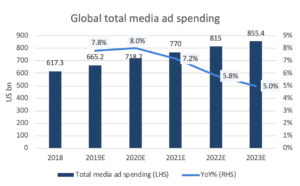

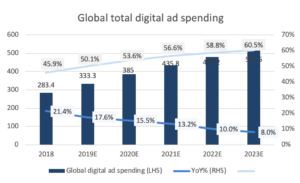

This growth is also supported by empirical evidence. Citi Research expects global advertisement spending to continue to increase into the foreseeable future, with growth rate of the digital advertising space higher than that of traditional platforms.

Global media ad spending versus digital ad spending

Source: eMarketer, Citi Research, April 2020

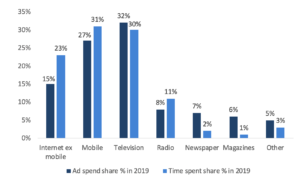

Furthermore, data seem to point to an overspending in traditional advertisement platforms (television, newspapers, magazines etc.), with the percentage spent on advertisements exceeding the media consumption percentage. Therefore, there is room to shift marketing budgets globally to digital sphere segments such as the internet and mobile advertising.

US media consumption versus ad spending

Source: Credit Suisse European Media Team, May 2020

Internet of Things (IOT)

The core principle behind IOT is the connection of various disparate devices via the internet, with these devices all collecting and sharing data. The integration of various unique streams of data in real time allows for an enhanced level of digital intelligence, creating a smarter and more responsive world; this would not have been possible if these devices were operating individually.

McKinsey & Company reports that investments in IOT are projected to grow at 13.6% annually through 20221 and Statista reports that end-using spending of IOT solutions worldwide will reach USD 1,567 billion by 2025. The following are the key drivers of the IOT revolution:

(continued over page)

Page: 1 2