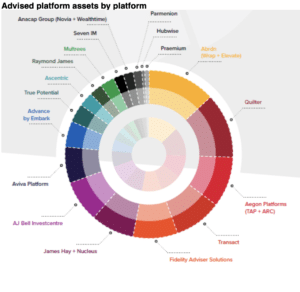

Advised platform assets continue to be dominated by a handful of brands, according to the lang cat’s latest annual State of the Platform Nation Guide.

While 18 of the 21 platforms included in the guide enjoyed double-digit growth in gross inflows in 2021 compared to 2020, the smaller players on the list made little headway against the market leaders.

The top five leaders – abrdn, Quilter, Aegon, Transact and Fidelity – were found to control over half (53%) the assets in the sector. The lang cat said that comparing the top half of the sector to the bottom half, the top nine organisations accounted for 81.6% of client assets.

The bigger platforms also dominated when it comes to new business inflows, with seven of the largest nine platforms by assets under administration also appearing in the top half of the table for both net and gross flows.

Steven Nelson, insight director of the lang cat, said: “Despite all the talk of disruption in recent years, a platform’s size in AUA terms continues to correlate strongly with its new business flows. Although some of the newer players like Multrees and Hubwise have seen phenomenal year-on-year growth, their lower starting point means that they have some way to go to catch up with the bigger boys and girls.”

“Much of the strength of these propositions is in their appeal to advisers and wealth managers who want to become the masters of their own destiny by building a technology ‘stack’ that best fulfills their client proposition.

“Our research shows that only a significant minority of firms have looked into this model thus far but interest is growing. Although it’s not for everyone there are advantages to the ‘adviser as platform’ model and it’s an area that we expect to see considerable sector discussion.”

[Main image: alex-quezada-hscnBlx_DRE-unsplash]