In the latest of her articles for Professional Paraplanner examining funds achieving their three-year track records, Juliet Schooling Latter, research director, FundCalibre, focusses on the Allianz China A-Shares fund.

It’s been a tough 18 months for Chinese equities, as attitudes towards Russia over the war in Ukraine, zero-Covid lockdown policies and the overhang of regulatory interventions have all created significant negative sentiment across the asset class.

As a result, Chinese equities have fallen over 33 per cent in that time*. Investors have been concerned about the end game, particularly as the government looks to tackle what it sees as the threat to its long-term economic stability—income inequality, unequal access to healthcare and education, speculative bubbles and anti-competitive practices all come to mind.

But surely a 33 per cent fall in the world’s second largest economy makes it an attractive entry point? We know about the rapid growth of the middle class as it moves to a consumption-led economy, but China is also building new cities and improving infrastructure. The current high-speed rail network is 23,500 miles of lines crisscrossing the country – quite an achievement when you think China had no high-speed railways at all at the beginning of the 21st century**.

There is also the diversification argument. At a time when the world is raising rates to tackle inflation, China is cutting them to promote growth, as the country fights to boost its virus-hit economy.

But I can fully understand the concern – which brings me to A-Shares – an area of the market all investors will have to consider when investing in Chinese equities.

A-Shares are domestic Chinese stocks, which account for more than 70 per cent of all companies in China***. In a world where growth is looking extremely hard to come by, this looks a real opportunity to tap into an early-stage opportunities, provided they can withstand the volatility.

For example, at a time when asset correlation is being significantly questioned amid market falls, A-Shares offer true diversification to global equities. In fact, China A-shares have only had a 0.32 correlation with global equities in the last 10 years (on a scale where 1 is fully correlated and 0 is completely uncorrelated)****.

This means that A-shares move in a different direction to global equities almost 70 per cent of the time. Contrast that to US equities which have a 0.97 correlation to global equities****.

A-shares were also less affected by last year’s clampdown by the government on the large tech and education firms, which tend to be represented by the Hong Kong-listed stocks and US-listed ADRs (American depositary receipts). By contrast, A-shares tend to feature companies in sectors like industrials, healthcare and consumer goods****.

There is also the diversity of returns from a sector perspective within the A-shares market – with a consistent rotation of top performers underlining the market depth****.

But you need an experienced hand in this space – step forward this month’s fund: Allianz China A Shares.

The fund has been headed by Anthony Wong and Kevin You for almost three years, but the team has been operating in the market far longer than most of its competitors.

As the name suggests, the fund only invests in Chinese A-shares. The managers do not rely on simplistic investment screens despite the very large nature of the A-share market. However, they do exclude stocks below $1bn (£752m) market cap to remove the smallest companies with low liquidity.

Each analyst on the fund covers 30 to 50 stocks in depth with a lighter monitoring of around another 100 names. The approach is narrow and deep with research focused on parts of the market that are ignored by others.

The fund has a ‘growth at a reasonable price’ philosophy and the managers have three main investment considerations. Firstly, is the company growing faster than the market and is the growth sustainable?

Secondly, does the company have a strong balance sheet and is it well capitalised? The managers look to see if its cash flow has a favourable outlook and transparency of accounts, as well as assessing company culture and management.

Finally, they will look at valuation using a variety of different metrics depending on the industry.

The team also benefits from the Grassroots Research division of Allianz Global Investors. Grassroots is a separate entity that conducts investigative research at a local level. This allows the team to get information faster and more accurately than the market. The team typically commissions 45 Grassroots reports a year.

The final portfolio typically consists of 50 to 70 holdings, predominantly in larger companies. Ongoing charges stand at 1.38 per cent^.

The A-shares story is still at a very early stage for many investors, but it is only going to grow exponentially from here, despite being vastly underheld by investors today.

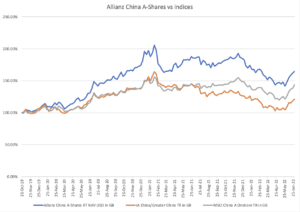

This fund has a stellar track record, with Anthony and Kevin returning 69.2%^^ for investors over their tenure. This compares with 23.3% for their peer group and 7.9% for the wider market^^. I believe it is ideally placed to tap into future growth and is an ideal option for those looking to diversify their investments.

*Source: FE Analytics, total returns in sterling, MSCI China, 17 February 2021 to 4 July 2022

**Source: CNN

***Source: Allianz Global Investors

****Source: Allianz Global Investors – Allianz GI China A-Shares presentation – February 2022

^Source: fund factsheet, 31 May 2022

^^Source: FE analytics, total returns in sterling, 23 October 2019 to 4 July 2022, using the IA China/Greater China and MSCI China index.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.

[Main image: