In the 2021 Budget it was announced that the lifetime allowance (LTA) would be frozen at its current level for five years until 6 April 2026. Naturally, that has prompted a lot of discussion because of the potential impact on clients’ retirement planning, but what is the lifetime allowance, where did it come from and why was it introduced? Stephen McPhillips, technical sales director, Dentons Pension Management Limited, takes paraplanners through the answers.

What is the lifetime allowance?

The lifetime allowance is the maximum amount of pension scheme funds that can be or deemed to be, ‘crystallised’ (usually to provide benefits), in relation to all of a pension scheme member’s registered pension schemes, without incurring a penalty tax charge.

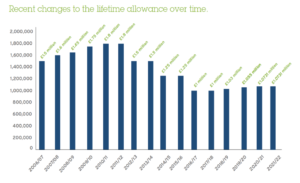

The standard lifetime allowance for tax year 2021/22 is £1.0731 million, as it was for the 2020/21 tax year. In previous years, it has been different, as the table below shows.

Provided that the value of all an individual’s benefits from all Registered Pension Schemes which are put into payment do not exceed their remaining lifetime allowance there should be no tax penalty.

However, when benefits are put into payment and the total value of the fund used to provide the benefits exceeds the individual’s remaining lifetime allowance, there will be a tax charge on the excess of 25%, or 55% if the excess is taken as a lump sum. The option to take the excess as a lump sum subject to a 55% tax charge is only available before the member’s 75th birthday.

Instead of increasing each year in line with the consumer prices index (CPI) as had been planned, the lifetime allowance has been frozen at its current level of £1.0731m until 6 April 2026 as noted above. HM Treasury estimates that this will raise £990m over 5 years through a combination of –

- reduced tax relief being claimed on pension contributions and;

- more members being subject to a lifetime allowance tax charge than would have been the case, had the lifetime allowance not been frozen

Where did the lifetime allowance come from?

The lifetime allowance was introduced on 6 April 2006 (“pensions A-Day”) as part of a package of measures designed to simplify pensions. Prior to A-Day, there existed a complex structure to private pensions. Pension scheme members could be in one or more of 8 different benefit “regimes.” Within an occupational pension scheme environment, members could be categorised differently, depending on when their membership of the scheme began. For example, in the case of a “pre-1987” member, there was no cap on pensionable salary when it came to calculating the member’s maximum tax free lump sum and pension entitlements. However, a scheme member who joined after March 1987 (after a change in legislation) was subjected to a cap on pensionable salary of £100,000 for tax free cash calculation purposes, but not for pension purposes. A scheme member who joined after March 1989 (after a further change in legislation) was subject to a different cap on pensionable salary, and that cap affected both tax free lump sum and pension calculations.

Different rules on pension contributions and benefits applied to personal pension schemes, which, in turn, differed from retirement annuity contracts.

One of the reasons why a number of benefit regimes existed was because of so called “grandfathering” within occupational pension schemes. Here, members who had saved in good faith under one set of rules, typically had their positions protected when the rules changed.

Hence, there was significant complexity to pensions prior to 6 April 2006, and the measures introduced from there on were intended to simplify matters by creating uniformity on tax relievable pension contributions and benefits in money purchase (defined contribution) arrangements. The lifetime allowance (along with the “annual allowance”) were part and parcel of the approach to simplify pensions.

Lifetime allowance “protection”

As our table shows, the lifetime allowance has varied considerably over the years since it was introduced. For the first five years of its existence, a series of pre-planned allowance amounts was in place, and the lifetime allowance rose from a starting-point of £1.5m (2006/07 tax year) to a peak of £1.8m in the 2010/11 tax year. In fact, it stayed at that level in the 2011/12 tax year.

However, from its peak of £1.8m, a number of downward revisions took place, ultimately reducing the lifetime allowance to a low point of £1m in both the 2016/17 and 2017/18 tax years.

Fortunately, for those scheme members who may / would have been affected by the lifetime allowance and changes to it, various forms of protection have been made available to them, to mitigate some / all of its effects. These lifetime allowance protections continue with the theme of “grandfathering” in as much that they seek to recognise that a pension saver had saved in good faith under the rules at that time; with a change to the lifetime allowance, a mechanism was created to provide protection against that change.

Various forms of protection now exist, and their interaction with each other can be complex. The only forms still open for new applications are Fixed Protection 2016 (which protects the member’s lifetime allowance at £1.25m, but does not permit new contributions) and Individual Protection 2016 (which protects benefit values as at 5 April 2016 between £1m and £1.25m and allows for new pension contributions to be made).

Lifetime allowance protection can be an extremely valuable benefit to a pension scheme member and great care needs to be taken to ensure that it is not accidentally or inadvertently broken by some other action (such as making new pension contributions and so on) – otherwise, significant and unwanted tax charges might apply.