After a period of ‘special measures’ to help boost the UK property market during the pandemic, Angelo Kornecki, technical director at Redmill Advance, provides a reminder of how Stamp Duty Land Tax now works.

Stamp Duty Land Tax (SDLT, England & NI), Land Transaction Tax (LTT, Wales) and Lands and Building Transaction (LBTT, Scotland) have all been affected as a result of the COVID pandemic with special measures being implemented to help support the property industry and encourage property purchases and the results show that it certainly worked.

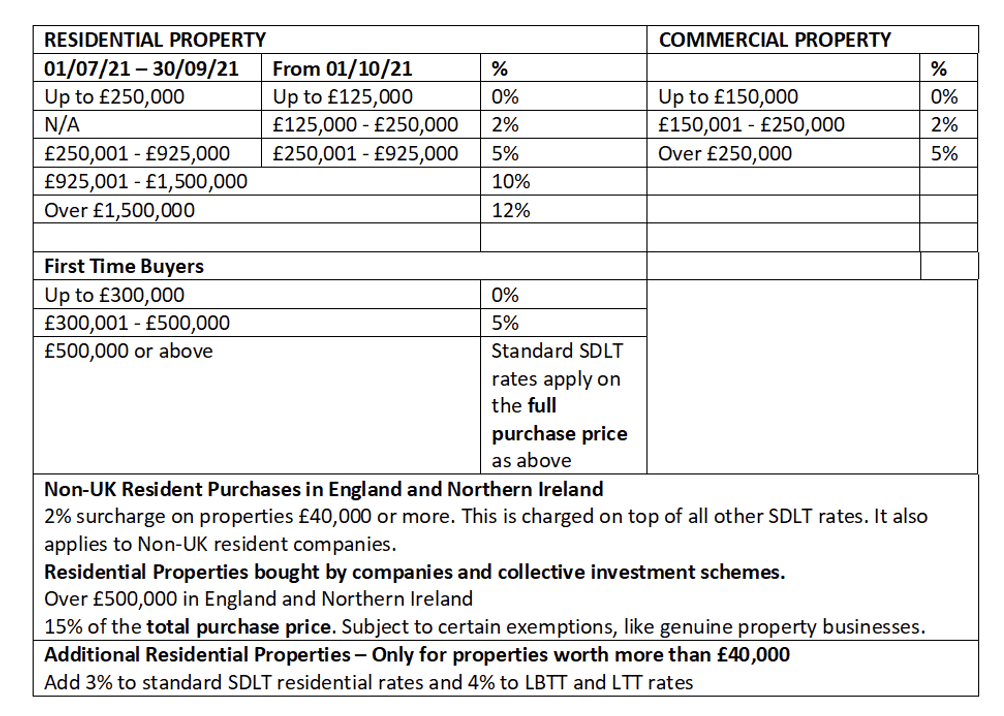

The introduction of an increased 0% threshold (SDLT holiday) to a whopping £500,000 applied from the 8th July 2020 to 31st June 2021 where it was then reduced to £250,000. From the 1st October 2021 it will reduce again to a pre COVID level of £125,000.

The headline findings in the government’s recent quarterly report* published on the 4 August 2021 show that residential property transactions in Q2 2021 were a staggering 175% higher than Q2 2020 (the quarter before the increase in the 0% threshold). Clearly the SDLT holiday had the desired affect and allowed people to pull the trigger on that “dream home” without the financial burden of thousands of pounds of Stamp Duty Land Tax to pay.

These measures have successfully fuelled the property market to a point where valuations are sky high, yet people are still willing to buy at a rate of knots. As a result of this and the fact that SDLT thresholds have started to reduce means there has been a huge spike in SDLT receipts (both residential and non-residential combined) in Q2 2021 to the tune of 92% higher than those in Q2 2020.

Let’s just remind ourselves how SDLT works (the same principle applies to LTT and LBTT)

It’s all based on the purchase price (less the value of any fixtures and fittings). The price you pay will dictate how much SDLT you pay, with elements of the price falling into the various “bands”. Each band has a corresponding tax rate. You pay the tax based on the portion of the purchase price that falls into each band. Once you’ve calculated the amount of tax relevant to each band, you simply add them together to find the total SDLT liability.

See the table below, using a very basic example to illustrate the point:

If we assume a purchase price of £600,000 and that this is after the 1st October 2021, we are not first time buyers and this is our only property (special rules apply for additional residential properties as mentioned below), let’s work out the tax.

As we can see:

- the first £125,000 is taxed at 0% = £0 SDLT

- The next £125,000 is taxed at 2% = £2,500 SDLT

- The next £350,000 is taxed at 5% = £17,500 SDLT

- Total SDLT = £20,000

You will see that things get a little more expensive when you start to buy additional residential properties. The rule here is that for properties over £40,000 you add 3% to the normal SDLT rates, therefore removing the 0% band and replacing it with a 3% one.

A final note on first time buyers in England and NI. They can claim a relief which essentially provides them with a 0% band on the first £300,000. They are then taxed at 5% on the portion of the purchase price between £300,000 and £500,000. However, remember, if the purchase price is over £500,000 then they are not eligible for the relief and they pay the standard SDLT rates on the total purchase price based on the above table.

First time buyers in Scotland pay 0% on the first £175,000 with first time buyers in Wales not receiving any form of special treatment (however the standard 0% band in Wales is £180,000).

*The full report can be found at https://www.gov.uk/government/statistics/quarterly-stamp-duty-land-tax-sdlt-statistics/quarterly-stamp-duty-land-tax-sdlt-statistics-commentary