With the end of the tax year visible on the horizon, it’s time to make sure that clients are taking full advantage of their 2021-22 tax planning opportunities.

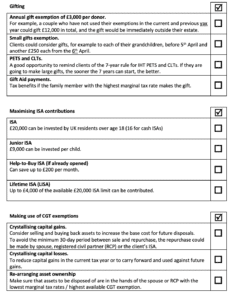

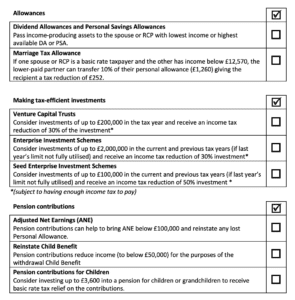

In this article, Jeff Scholes, director at Bespoke Training Services, provides a visual portrayal of a range of options and a reminder of the key considerations, what can be done, and some of the advantages.

Acting on some or all of these options can save clients substantial amounts of taxation, opens up lots of other financial planning conversations, and adds to the value of the client’s relationship with their financial adviser.