In a new series for Professional Paraplanner, Lawrence Cook, head of UK Intermediary Distribution at Sanlam, presents the group’s views on the megatrends shaping the future of investment.

This first article examines the rebranding of the oil & gas majors and asks: Is it greenwashing or sound common sense?

Interest in renewable energy sources has intensified as countries seek to move away from fossil fuels to meet the climate change targets set out in the Paris Agreement.

In order to balance global demand for energy with society’s calls for lower emissions, companies within the energy sector are starting to transition towards a more sustainable business model – and this is creating long-term investment opportunities.

While the shift towards renewable energy sources has gained momentum, the oil and gas (O&G) industry – for so long a stalwart in investment portfolios – has faced additional challenges, including price volatility, a coronavirus-driven drop in demand, and the rising cost of oil exploration and extraction. In response to this disruption, O&G companies are seeking to diversify their business models to focus on sources of long-term growth.

Looking beyond the oil majors

Activists and investors are urging the oil majors to step up and deliver the solutions that will bring the world closer to its net-zero objective. Unsurprisingly, the seven largest integrated O&G companies – BP, Chevron, Exxon Mobil, Royal Dutch Shell, TotalEnergies, ConocoPhillips, and ENI – have garnered most of the attention and criticism.

However, according to the International Energy Agency (IEA)[1], the majors account for only 12% of O&G reserves, 15% of global production, and 10% of estimated emissions from industry operations. In comparison, national oil companies (NOCs) – which are fully or predominantly owned by governments – account for more than half of all global production and an even greater proportion of reserves, and most are not well positioned to adapt to the changing landscape.

Companies in the spotlight

“No energy company will be unaffected by clean energy transitions. Every part of the industry needs to consider how to respond. Doing nothing is simply not an option.”

Dr Fatih Birol, IEA Executive Director[2]

O&G companies are coming under increasing pressure to play an active and tangible role in achieving the stated aims of the Paris Agreement, and to declare specific targets that can then be used to hold them to account. However, bodies such as The Climate Accountability Institute[3] have questioned whether the oil majors can be trusted to deliver on their promises.

Court-ordered change

In a move that may have far-reaching consequences for the sector, a Dutch court[4] ordered Royal Dutch Shell to reduce its carbon emissions more quickly than previously intended, to 45% from its 2019 levels by 2030. A lawyer for Friends of the Earth[5], which brought the case against Royal Dutch Shell in the Netherlands, commented: “This is a turning point in history … it is the first time a judge has ordered a large polluting corporation to comply with the Paris Climate Agreement”.

Activists on the board

During May, Exxon Mobil’s shareholders[6] voted two activists from hedge fund Engine No. 1 to Exxon Mobil’s board, with a third likely to join. Robert Eccles[7], a professor at Saïd Business School at the University of Oxford, described the move as “a good example of activist stewardship to help the company get the board it needs for the energy transition”. Despite this, Exxon CEO Darren Woods has reiterated the importance of oil and gas in meeting the world’s transitory energy needs, particularly in sectors that are harder to decarbonise – a view evidenced in Exxon’s recent five-year spending plan.

‘Greenwashing’

Greenpeace USA, Earthworks, and Global Witness launched legal action[8] against US oil giant Chevron for “greenwashing”, alleging: “Chevron is attempting to completely reshape its public presence to keep pace with the public’s perception of the climate crisis”. They alleged that the company invested only 0.2% of its capital expenditure in low-carbon energy sources between 2010 and 2018, while increasing its overall carbon emissions from 2017 to 2019.

Making changes

In August 2020, BP[9] set out its environmental strategy and redefined itself as an “integrated energy company”. By 2030, it intends to achieve a ten-fold increase in low-carbon investment and to reduce emissions from its extraction operations by 30-35%. The company will not initiate new exploration for oil reserves in countries in which it does not already have operations. BP’s foray into renewables includes a joint venture in solar power developer Lightsource, and investments in battery technology[10] and electric vehicle charging[11].

A global disconnect

The Covid-19 pandemic caused major disruption to the industry, driving down both demand and prices. While major O&G companies can pivot, the impact has been particularly severe for economies[12] that rely on revenues from O&G production and has clearly demonstrated the need for the principal exporters to diversify their economies.

A substantial drop in demand for O&G production is likely to have a dramatic effect on countries whose economies depend on fossil fuels, and who represent almost one-third[13] of the global population.

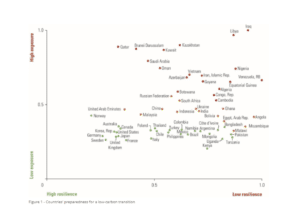

The chart below illustrates different countries’ exposure and resilience to the low-carbon transition.

Renewable energy and real assets

The issue of climate change continues to guide and shape political policy. Governments have underwritten the advancement and expansion of renewable energy solutions; in turn, this financial and legislative support has spurred the development of new technology, driving down costs, generating economies of scale, and creating attractive long-term investment opportunities. In many cases, these opportunities are accompanied by durable contractual revenue streams with built-in inflation protection – valuable characteristics for investors seeking stable returns amid volatile events like the global pandemic.

Renewable energy is a long-term theme that is set to play out over decades, and it makes up around 30% of the Sanlam Real Assets Fund. Real assets span a wide range of different sectors, from housing and transport to logistics, data warehousing, and renewable energy, and the investment universe continues to evolve. Looking ahead, energy will continue to generate long-term investment opportunities: demand for energy has not diminished, but demand for more sustainable energy has surged and the rate of change is gaining momentum.

[1] IEA, Jan 2020

The Oil and Gas Industry in Energy Transitions – Analysis – IEA

[2] IEA, Jan 2020

The Oil and Gas Industry in Energy Transitions – Analysis – IEA

[3] The Climate Accountability Institute, 15 Apr 2021

KennerHeede PR Apr21 (climateaccountability.org)

[4] Full text/Climate Case Chart, 26 May 2021

20210526_8918_judgment-2.pdf (climatecasechart.com)

[5] Friends of the Earth, 26 May 2021

Judge forces Shell to drastically reduce CO2 emissions | Friends of the Earth

[6] Exxon Mobil, 26 May 2021

ExxonMobil announces preliminary results in election of directors

[7] Saïd Business School/Twitter, 26 May 2021

[8] Earthworks, 22 Mar 2021

Why we’re holding Chevron accountable for its greenwashing campaigns – Earthworks

[9] BP, 4 Aug 2020

[10] BP, 24 May 2018

BP invests in ultra-fast charging battery company StoreDot | News and insights | Home

[11] BP, 30 Jan 2018

and

BP, 18 Nov 2019

[12] IEA, Oct 2020

World Energy Outlook 2020 – Analysis – IEA

[13] IEA, May 2021

Net Zero by 2050 – Analysis – IEA

Sanlam is a trading name of Sanlam Private Investments (UK) Limited (registered in England and Wales 2041819; registered office: 24 Monument Street London EC3R 8AJ). Authorised and regulated by the Financial Conduct Authority. The value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.