Origo has published its latest Origo Transfer Index, which tracks the transfer performance of some of the leading providers in the pensions and investment markets, when ceding money, on average typically one of the slowest processes for consumers.

Yearly figures recorded at the end of April 2019 and the end of June 2019 show a marginal improvement in overall average ceding performance of 9.3 to 9.2 calendar days, via the Origo Transfer Service.

The Fintech also marked a 20% rise in transfer volumes through the Origo Transfer Service year on year between 30 June 2018 and 30 June 2019, to over 680,000, which it attributes to new companies, such as NEST, signing up to the Transfer Service at the end of 2018 as well as the rise of transfer volumes across the community in general.

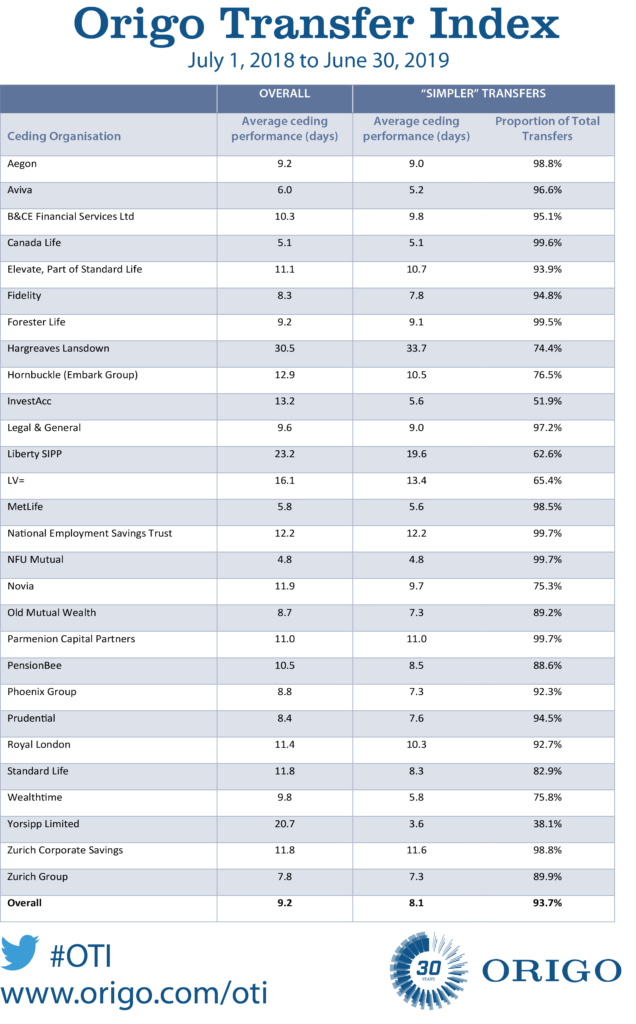

Of the group of 28 companies voluntarily publishing their data in a drive to improve the industry’s transfer times, the company producing the fastest average transfer time for ceding was NFU Mutual at 4.8 calendar days, whilst the slowest was Hargreaves Lansdown at 30.5 days.

This quarter, wrap platform Novia has joined the list of providers publishing their ceding data . NEST also is a participating member of the Origo Transfer Index. The transfer times for the period for these companies, respectively, was 11.9 and 12.2 calendar days.

Novia head of Technical Ben Collings says: “We are pleased to be joining other leading companies in publishing our transfer times through the Origo Transfer Index. This index will provide increased transparency for the industry and ultimately help to deliver a better service and improved outcomes for investors.”

Mark Rowlands, Nest’s Director of Customer Engagement, says:”It’s important our members have the ability to move their savings around quickly and easily. As this report shows NEST’s average transfer time has fallen to less than a fortnight, which is a great achievement in the nine months since we joined.

“While we’ll continue to offer quick transfers we also want savers to have clear information about how much each scheme charges. This will allow people to build up the retirement pot they want while knowing how much it’ll cost them, helping them to make informed decisions.

“It’s great to see so many schemes willing to share this key information and we encourage more to follow suit.”

Anthony Rafferty, Managing Director, Origo (pictured), adds: “Government and the regulator have made it clear that they have their eyes on transfer performances and consumers deserve better. It is important that the industry responds to this and so the regular publication of performance data is a demonstration of the commitment to strive for, and maintain, faster transfer times.

“Origo is committed to driving efficiencies and best practice in the industry, both through our work as a Fintech and through our long history of collaboration with the industry to get things done.”

He said Origo will encourage other platforms, providers and administrators “to also become part of the index, thereby helping to improve outcomes for individuals”.

The addition of Novia means 28 firms publish their data on a quarterly basis via the Origo Transfer Index of the 100+ brands on the service. The 28 equate to around 80% of the transfer volumes on the Service.