The amount of money invested in Junior ISAs each year has surpassed the £1 billion mark for the first time.

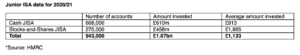

In 2020/21, families paid money into 943,00 Junior ISAs amounting to £1.07 billion. Since Junior ISAs were first introduced in 2011, a total of £7.15 billion has been invested.

However, NFU Mutual noted that with 70% of Junior ISAs invested in cash, families stand to miss out on the potential long-term growth that stocks and shares JISAs can provide.

David Nottingham, personal finance expert at NFU Mutual, said: “Junior ISAs are a great way to save for a house deposit or university fees in a tax-efficient environment, but many families are missing out on potentially higher long term returns.

“There are two types of Junior ISAs, cash-based JISAs and those invested in the stock market. Most families can benefit from the fact the money is locked away until a child turns 18, giving them time to ride out stock market volatility and reap the benefit of long-term investing through a Stocks-and-Shares Junior ISA. However, only 30% of Junior ISAs are invested this way.”

According to NFU Mutual, if someone invested £1,000 into the FTSE All-World ten years ago, it would be worth £3,090 today.

Nottingham added: “The majority of families play it safe and prefer to keep the money in cash savings, but families who invested their Junior ISAs in stocks and shares are likely to have made significantly better returns over the past decade.

“As we enter a period of high inflation, the value of cash may be eroded more quickly, so long-term investors should consider stocks and shares when opening a Junior ISA.”