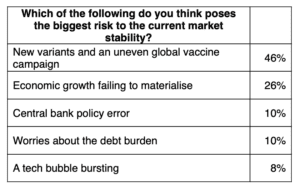

Advisers view Covid variants as a bigger risk to current market stability than economic growth failure, new research from Quilter Investors has revealed.

Nearly half (46%) of advisers said the new variants and failure to have a consistent global vaccine rollout would increase stock market volatility. In contrast, just over a quarter (26%) of advisers said a lack of economic growth after the lockdowns posed the greatest threat.

Meanwhile, just one in 10 advisers cited central bank policy error, while the same number (10%) said worries about the debt burden posed the greatest threat.

Paul Craig, portfolio manager of Quilter Investors Cirilium range, said: “We are in somewhat of an economic sweet spot just now as lockdowns end and demand returns. Companies are reporting tremendous earnings and consumers appear to be spending some of their lockdown savings as shops and holidays return.

“However, markets are forward looking, so ultimately much of this is already factored into the share prices we see today. As such it is not going to take a lot to spark some volatility in markets.

“It is interesting to see that advisers are most concerned with new variants and an uneven global vaccine rollout knocking markets off course, although these are ultimately two separate threats. So much is unknown about the new strains of Covid, so it is understandable if fears of another economic lockdown persist just as things begin to look up.”

Craig said the vaccine rollout will be crucial to bringing back global travel and trade but noted that any hiccups, including mutations, could leave the economic picture looking less positive.

“For advisers, it is clear diversification is more important than ever given this dual threat, and the existence of a number of risks out there just now. A focus on quality companies will see portfolios weather any storm that does come, while also benefitting in the post-pandemic economic environment,” Craig added.